Startups in India are seeing a favourable picture on their side amongst the entire financial crisis and the slowdown in the economy, including a slump in consumer demand, and continue to see a strong capital inflow in the form of Foreign Direct Investment and Venture Capital Funding.

The key to the growth here is “Tech”. According to the beliefs of Startup investors, the size of the firms are small and on their day to day, activities are based on a concept around which they build the prototype of the product or service they are offering to their customers.

Based on the trend of the last two years, startups in education, travel, FinTech and health care have dominated in terms of fundraising (startups like Paytm, Flipkart, Swiggy & Byjus). These startups are built on platforms which have immense need among their users even when the country faces a liquidity crunch or a fall in the economy. An added advantage of a good user interface makes their products more approachable to the consumers. Due to their tremendous potential and consumer demand and recession-proof business models, fintech, education, health care along with food logistics continue to dominate the Indian start-up funding story.

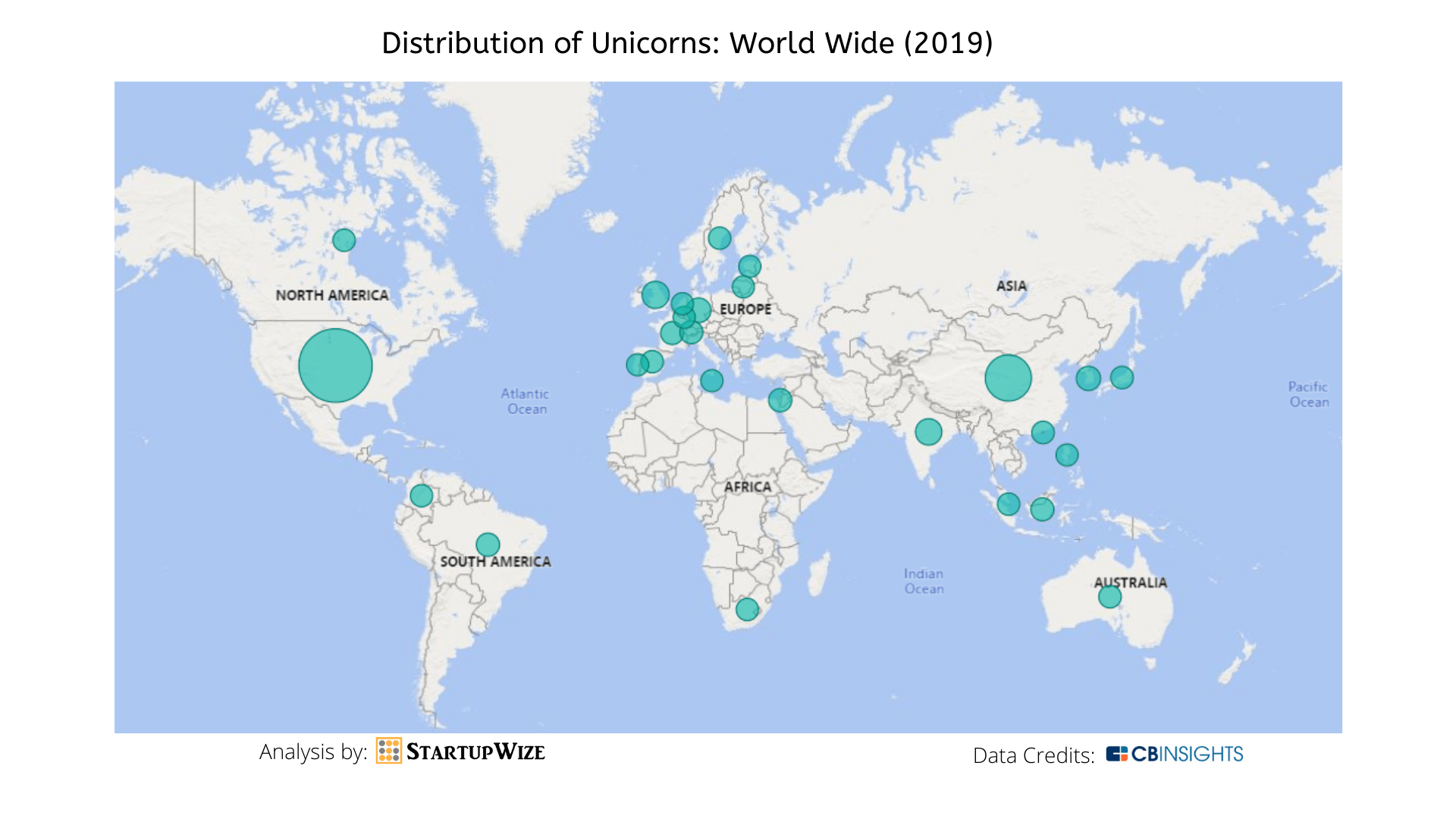

The startup community of India is the 3rd largest growing market in the world. By the end of the calendar year of 2019, the total funding poured into Indian startups since 2014 stood at $58 bn and the total count of funding deals stood at 5,011 investments. The investments have mainly been in some regions of the country mostly, like Bengaluru, Delhi NCR and Mumbai.

As the startup ecosystem moves from growth stage to maturity (Reported by KPMG), the funding amount and deal count have both stabilised over the two years from 2017 to 2019. In 2019, the total funding raised by tech startups in India across 766 deals was $12.7 bn, which is a 15% increase to that of 2018. In 2018, 697 unique Indian startups raised funding, and this figure fell to 664 in 2019, indicating that investors were more interested in investing in the funded startups, which were better poised for growth.

In these two years of Liquidity crunch and slowdown in the economy, the startups which have shown promising ideas have made an effort to gain a position in the eyes of the Investors. Seed Funding crunch and fewer investments from friends and family has also been a major reason why new startups couldn’t flourish as these investments serve as the foundation of every startup.

Mergers and acquisition deals have come up less on the table with some as trivial as Zomato acquiring Uber Eats which was already into losses. The potential pool for acquisition is going down each year and the underfunded Startups are less likely to attract major companies for acquisitions.

The Economic slowdown as a whole is a major factor that has been responsible in India’s Consumption and Investment decisions, but in the case of startups, the effect is less or may be null in some sectors. This is because of the factor that the startups that are emerging are from various sectors and some of which have been identified as a niche to the business plan. The other reason for this is the very evident fact of Technology that plays a major role.

At the end, it all zeroes down to the growth potential that each startup shows in its subsequent years of value addition and that what catches the investor’s attention.