Unicorns and Valuations: What is a Unicorn?

A “Unicorn” is a privately held start-up company worth more than a billion dollars. Venture capitalist Aileen Lee first coined the term in 2013, preferring the mythic character of a unicorn to reflect the statistical rarity of such productive projects.

How can a Private company be worth more than a billion dollars?

The valuation of unicorns derives from valuations established by venture capitalists and investors who participated in the company’s funding rounds. Since all unicorns are startups, their value is based primarily on their potential for growth and expected development. The value of the unicorns is not closely related to their actual financial results or other critical details.

Valuing unicorns is a complex process involving taking into account different factors and designing long-term forecasts. According to the business models of those businesses, potential problems also occur. Many companies are the first of their kind in the industry, making their valuation process even more complicated.

Valuation of tech companies is a complex and difficult process because the life cycle of the tech company is different. Initially, young companies will have a negative cash flow for a certain period of time but it’s not the end of the world. Eventually, it will be earning profits sooner or later.

For a company like Tesla, one should expect negative cash flows but now in recent days, its stocks were skyrocketing. Some companies show gradual growth and it takes quite some time to reach the maturity stage of the life cycle and resilience to rise and fall and rise again. These types of companies are called Phoenix, like Fiat Automobiles.

Types of Unicorns

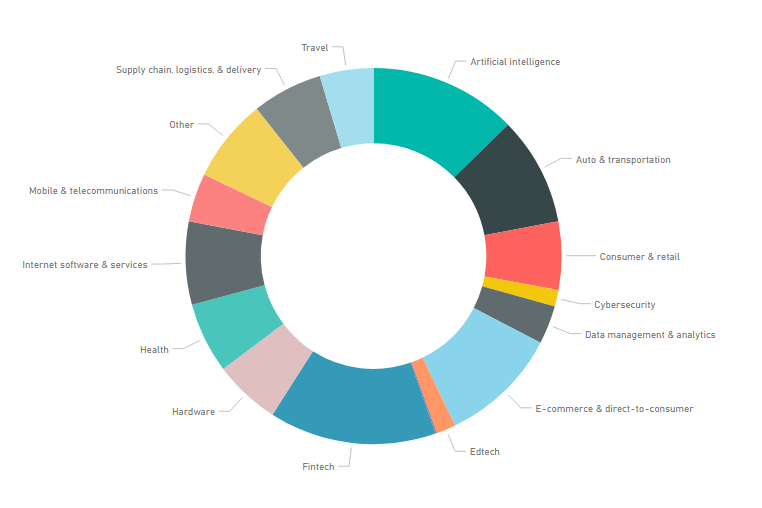

Unicorn companies fall into 4 major business models somewhat evenly: consumer e-commerce, consumer audience, software-as-a-service, and enterprise software. In which, Consumer-oriented unicorns are more common and have created more value for example retailers like JUUL Labs, Fintech like Stripes and etc. But enterprise-oriented unicorns have become on average worth more, attracting much less private capital, yielding a higher return on private investment.

How are Unicorns different from major mature companies?

Most of the tools we have in finance were developed for mature companies. In the case of a growing company, it’s different. For example, for the valuation of Snapchat, the company had no revenue but plenty of potentials. Sometimes team members play a promising role in the valuation process.

Unicorn Success stories

Online food delivery start-up Swiggy posted a loss of ₹137 crores in FY16. At that time, its valuation was about ₹1,307.30 crore or nearly $250 million. In FY18, its loss almost tripled to ₹397.30 crores but its valuation zoomed to ₹8,660.40 crores or $1.4 billion (livemint). Here the valuation is called “Inverse proportionality”. Generally, valuations are a function of the projected revenue, based on assumptions that unit economics will work out once the competition is over.

Some Unicorn disasters

Softbank never feared running out of cash so they invested even in a losing company as long as they tend to grow in the future, but most of the companies did not. Here is a perfect example of this type, Softbank has invested around $7.5 billion directly in WeWork. The valuation of WeWork was once said $47 billion but its efforts are now focused on avoiding bankruptcy. WeWork was a unicorn.

Another popular example is Theranos, founder Elizabeth Holmes was valued at $1 billion in the FY2010. With less revenue later in 2015 the company was valued at nearly $10 billion. The mission and vision of the company never came true as promised. The company was charged with fraud cases for faking its products and went from high to low instantly. Here the investors only saw the future profitability of the company and since there were no competitors in the field so the valuation skyrocketed.

Big to Unicorn

Let’s see how “a big company” transforms into “a Unicorn”. Depending on the business, some start-ups will be valued a billion by VCs in early series B or C like Desktop Metal, A metal 3D printing company that started in 2015 in Massachusetts, United States was joined in unicorn club within one year, nine months. In some cases, start-ups will take many numbers of series and time to become a unicorn, Info Edge, an Indian company that is a leading provider of online recruitment, matrimonial, real estate classifieds, and related services, took 19 years to become a unicorn. Likewise In the late 1990s, Lynda Weinman started as an instructor seeking tools to advise web designers. The offerings at bookstores were boring, so she started producing training films that offered her students a better education. Her company’s tutorial helped software developers and designers improve their capabilities. She spent two decades building a library of content and tech assets known as Lynda.com that had enough scale to attract LinkedIn to pay $1.5 billion to acquire the business.

Key Takeaways

It takes a lot of time and effort for most successful start-ups to break out as unicorns. While the vesting periods are usually four years, the most valuable start-ups will take at least eight years before a “liquidity event,” and beyond such an event, most founders and CEOs will remain in their business. Unicorns also tend to raise a lot of capital over time— well beyond Series A. Thus these founding teams were able to share a compelling company vision over many years and fundraising rounds, plus scale themselves and recruit teams, despite economic ups and downs.