Revisiting Airbnb's IPO in 2024

Back in 2020, Airbnb’s planned IPO was one of the most anticipated public offerings of the year. The company had filed confidential IPO paperwork in August 2020, aiming to go public before the end of the year. At the time, Airbnb was still recovering from the impacts of the COVID-19 pandemic, which had severely disrupted the travel and tourism industry.

Airbnb ended up completing its IPO in December 2020. Despite the challenges of 2020, the offering was a huge success. Here’s a look back at Airbnb’s IPO journey and where the company stands today in 2024.

A Brief History of Airbnb

Founded in 2008, Airbnb operates an online marketplace for lodging and tourism activities. Users can list spare rooms or entire homes for short-term rentals. As of 2020, Airbnb had over 4 million hosts worldwide and a presence in over 220 countries.

"The best pitch decks are concise and use just a single slide to explain each topic."

-Pitch

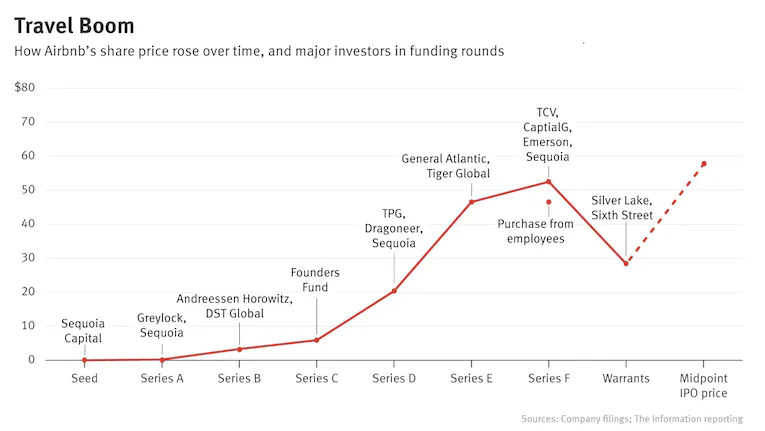

Before the IPO, Airbnb had raised over $4.4 billion in funding. The company was profitable in 2018 but reported losses in 2019 due to heavy investment in marketing and R&D. Revenue took a further hit in 2020 as the pandemic crushed travel demand.

The Airbnb IPO in 2020

Airbnb priced its IPO at $68 per share, above the initial expected range of $44-$50. The company sold 51.9 million shares, raising $3.5 billion at a valuation of $47 billion.

Shares began trading on Nasdaq on December 10, 2020 under the ticker symbol ABNB. The stock popped on the first day, closing up 112% at $144.71 per share. This gave Airbnb a valuation of $86.5 billion.

The successful IPO was seen as a vote of confidence in Airbnb’s business model despite the pandemic’s impact. Investors were attracted to the company’s rapid growth, loyalty among hosts and guests, and its asset-light platform.

Airbnb in 2024

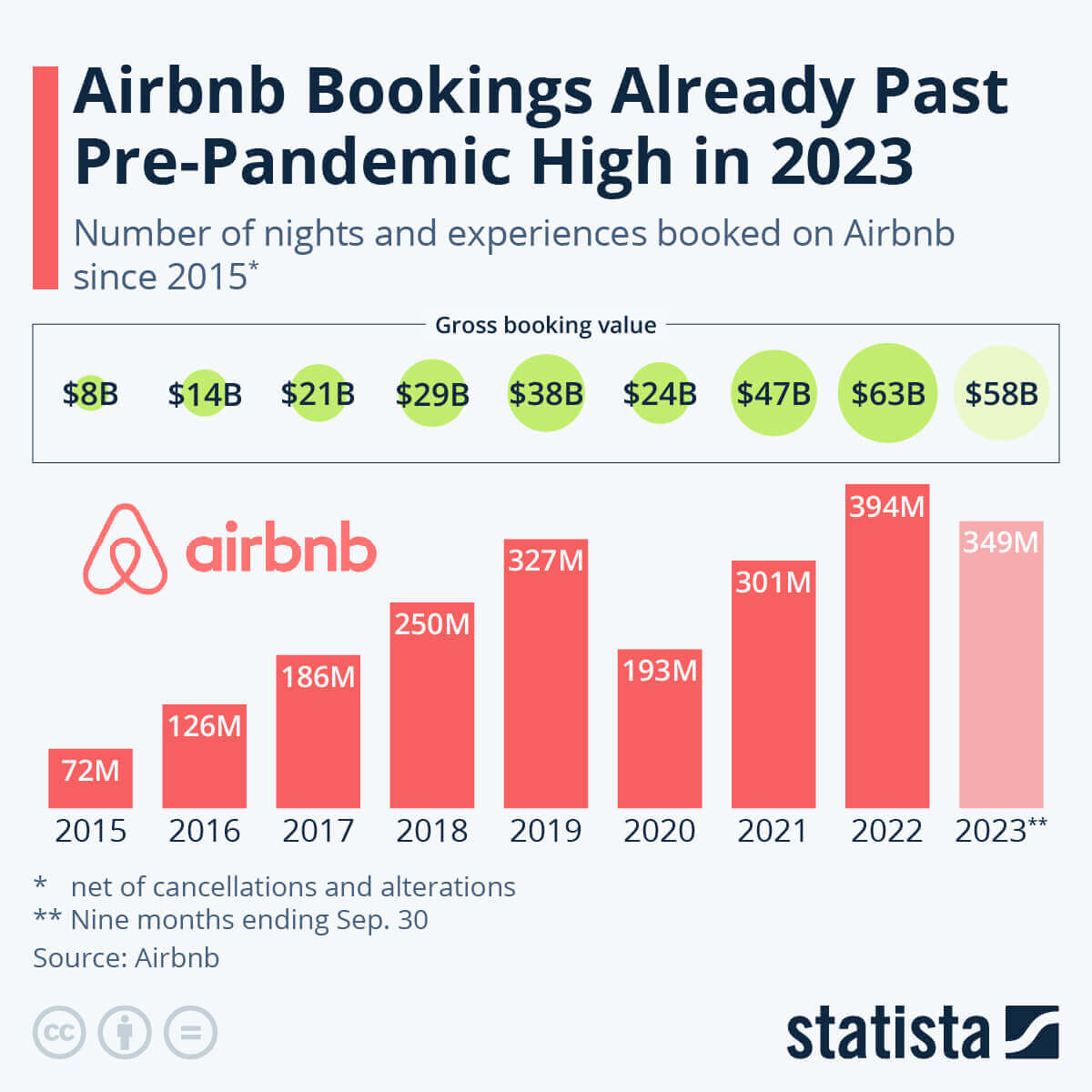

In the 3 years since going public, Airbnb has continued to perform well. The travel recovery has boosted demand, with revenue and bookings exceeding pre-pandemic levels.

Some key highlights for Airbnb:

- Revenue for Q3 2023 totalled $3.4 billion, grew 14% year-over-year.

- Net income was $1.6 billion making Q3 the most profitable in 2023.

- Active listings have exceeded 113 million as of Q3 2023.

While the pandemic recovery has been a tailwind, Airbnb has also executed well on its growth strategy. Initiatives like improving trust and safety, expanding into luxury rentals, and offering flexible cancellation policies have helped drive results.

As the travel industry continues rebounding, Airbnb looks poised for more growth ahead. The successful IPO has given the company financial flexibility to keep investing in the business. Overall, Airbnb remains one of the pandemic-era IPO success stories.

Need to Take Your Business to Next Level?

Schedule a free consultation call with our team today

Looking Ahead

Airbnb still faces some challenges and risks to monitor. Regulatory issues around short-term rentals continue to pose a threat in some cities. Competition also remains fierce in the sector.

However, Airbnb has several strengths that should help it navigate these issues:

- Global scale and brand recognition. Airbnb is synonymous with home sharing.

- Loyal customer base. Over 90% of bookings come from repeat guests.

- Ability to adapt offerings to new travel trends, as evidenced during the pandemic.

While the future is uncertain, Airbnb’s leading position in the market and strong track record since going public point to continued success. The IPO unlocked growth opportunities for the company, and Airbnb still has room to run.

Want to visit the story of Airbnb during IPO?