PRADHAN MANTRI MUDRA YOJANA

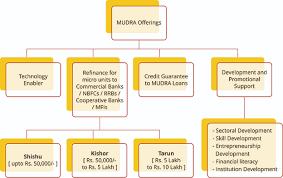

Pradhan mantra mudra yojana (PMMY) is a scheme launched by our Prime Minister Mr. Narendra Modi with the aim of providing loans to small businesses, startups up to Rs 10,00,000. Here MUDRA stands for Micro Units Development and Refinance Agency, is a financial institution that help small businesses in borrowing money from the bank for non- farming income generating activities. MUDRA doesn’t provide loans directly but facilitates the same through banks, NBFCs and other FI’s.

.MUDRA is a subsidiary whole owned by Small Industries Development Bank of India (SIDBI) which is responsible for developing all SME units by helping them with the necessary finance and related support.

Who is eligible under this scheme?

- Applicant should have a minimum age of 18 years and maximum age of 65 years.

- Business owners

- Startup Entrepreneurs

- Small Manufacturers and Industrialists

Types of MUDRA loans:

MUDRA loans are classified on the basis of financial requirement of the startups. The 3 main types of MUDRA loans are:

Shishu

This category of loanis targeted at small start-ups where the owners need small capital uptoRs 50,000.

Kishore

In this category, the targets are the business who have already commenced their business and want establish a better enterprise. Here the loan amount ranges from Rs 50,000 to Rs 5,00,000.

Tarun

In this category, the targets are the business that are established and need more capital for their expansion. The business owners are eligible for loan amount ranging from Rs 5,00,000 to Rs 10,00,000.

Interest Rates charged on these loans are

Shishu: The interest rate under this scheme starts at 12% annually

Kishore: The interest rate depends on the bank sanctioning the loan and the creditworthiness of the applicant.

Tarun: The interest depends on the bank, creditworthiness and also varies on case to case basis.

Benefits of MUDRA Scheme

- It bridges the shortfall of money in business

- It help the entrepreneur save on more interest.

- No collateral is required

- Do not levy any processing charges

This scheme was introduced by our Prime Minister to motivate the people to start their own business. The aim of this scheme to provide financial assistance to small businesses, startups etc. so that they develop their business and helping this business grow would ultimately lead to growth of the economy.